BETTER KYC PROCESSES THANKS TO DIGITAL SOLUTIONS

Backlogs of KYC files are a thorn in the flesh of many compliance experts, because the standardized and careful processing, checking and updating of KYC forms and KYC checks causes enormous effort. But it doesn't have to be that much of an effort. There are many digital compliance solutions available for banks and financial intermediaries that facilitate KYC and thus also overall compliance. Find out more about how (partially-) automating your KYC processes allows you to free up time for the more important task of Risk Management and leaves you to focus on your core competencies.

KYC stands for "Know Your Customer" and is an important tool, especially for the financial sector, for checking the identity and compliance status (sanction lists, PEP status, CRIME, black or watch lists) of their customers. KYC is part of the due diligence of financial intermediaries as part of a compliance process and aims to prevent economic crime or money laundering.

For banks in Switzerland, KYC checks before the start of a contractual relationship are a means of meeting the regulatory requirements of FINMA. This involves checking whether business partners are trustworthy based on suspicious transactions or hits on a risk list (e.g. sanctions lists or PEP lists).

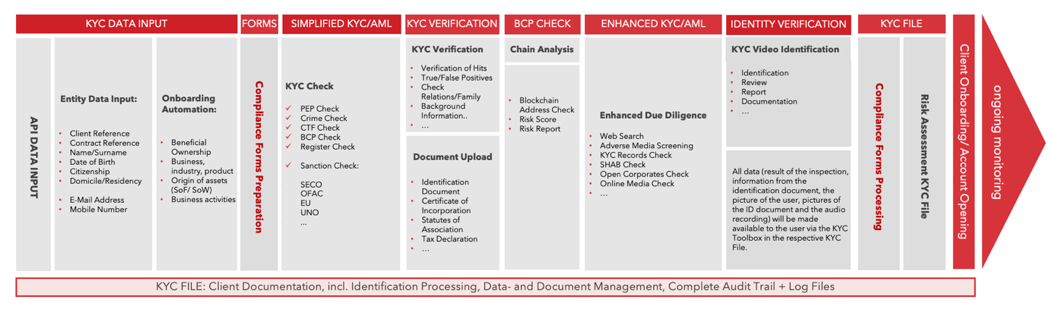

In the KYC compliance process, a natural or legal entity is either identified and checked for critical risks as part of an onboarding process, or repeatedly checked as part of an onboarding monitoring process.

When onboarding new customers or business partners, data on the business partner must be collected initially. This data collection can take place at various touchpoints. Be it at a bank counter, via a printed form or online, in form of a digital onboarding process. In one or more steps, information about the entity such as; name, e-mail, telephone number, date of birth, home country and domicile is being collected.

As soon as you have collected the relevant entity data, the business partner is checked for possible connections to PEP, crime or sanctions lists as part of a simplified KYC/AML check. Blockchain Address Check as well as company register entries are collected in order to fully assess the risk of the business relationship in its entirety. It is particularly important that you identify your contractual partner in accordance with the regulatory requirements. In the digital world, digital solutions such as video identification and online identification are replacing traditional identification methods like personal visits or the delivery of authenticated documents on correspondence. Depending on the industry, special requirements of the regulator apply here, which must be observed. The following FINMA RS applies to the financial market today. In order to check your business partner's data, you must request identification documents such as passport/ID, commercial register entry, articles of association, as well as any other information on the financial situation and tax domicile, etc. Ideally, the documents are automatically and digitally stored in a corresponding KYC file.

If through the KYC Check or Verification Check anan increased business risk is identified, an in-depth Due Diligence ("Enhanced Due Diligence") is necessary. The business partner is also checked on negative media reports in connection with compliance-relevant content, the business relationships and ownership structures are researched, and any reputational risk shall be prevented. This should also be done using data from publicly accessible databases, as required.

The aim is to digitize the entire process and automate it to the highest possible extent. All data collected on the KYC file is logged and sorted according to their respective specifications. The KYC file is intended to provide all documents relevant to an audit in a simple, documented and unalterable form at any time.

As soon as a business relationship has gone through onboarding, the contacts are continuously checked for any new risk factors. Potential hits, i.e. compliance relevant hits in the database check, should only appear again for a renewed KYC Check process, if there has been a change and flag in the critical status of the entity (whitelisting). Batch screening or monitoring must be easy to use and provide a clear overview of any compliance-relevant changes. Automatically generated log files and reports facilitate the process for the users as well as the handling via the same interface in order to integrate the regular re-examination of business relationships in day-to-day business.

The manual KYC processes and controls have a high potential for error. According to Synpulse, KYC processes are becoming increasingly complex, partly due to new controls required in connection with increasing regulatory requirements, such as those resulting from FATCA, AIA and MiFID II, and lead to an error rate of 10% to 30% depending on the customer segment. With the digitalization of process steps, this risk can be reduced considerably by collecting standardized data and evaluating it according to rules and regulations. [1]

For new customers of a bank, the onboarding process today can take several iterations or even several weeks, as the regulatory requirements for banks have increased significantly in recent years.

In order to simplify the onboarding process for customers, digital forms are therefore an ideal solution, as these are not tied to opening and maintenance times and a specific location, but can be executed at any time - 24/7 - in an individual customer language.

The KYC checks processes are extremely cost-intensive due to the high personnel expenditure. 58% of the KYC experts surveyed answered according to the Know Your Customer Survey (2017) that the expenditure for KYC processes has increased compared to the previous year. Digitization offers perhaps the greatest opportunity to improve and simplify the KYC process. Your compliance experts are relieved of work and may concentrate on the more complex core tasks of their compliance work. [2]

Digitisation is quickly pronounced, digitisation projects are on everyone's lips - but the implementation is not quite as simple. To help you standardize your KYC compliance with a digital solution you should consider the following 6 tips for implementation:

Various banks and financial intermediaries operate in the financial market with different compliance requirements and challenges.

Depending on the company structure and the applicable regulatory framework, there are various digital solutions for simplifying KYC processes that can automate parts of your compliance process:

From a holistic point of view, and in terms of the risk management of your company, Simplify your Compliance therefore means to implement processes and standards based on rules and regulations, supported by software, and thus to enable the different user groups to carry out uniform procedures that eliminate error rates as far as possible.

KYC Spider is a full-service provider for implementing your digital KYC process. With the comprehensive KYC 4.0 Solution Suite, we help you simplify your compliance. Our digital compliance solutions offer a simple, intelligent and secure compliance process for continuous screening and monitoring of your business partners.

The KYC Toolbox supports you in complying with regulations relating to money laundering and the prevention of terrorist financing. By combining various due diligence applications for identification during onboarding of your business partners. The KYC Toolbox is based on Swiss regulations, i.e. the legal requirements as well as FINMA and SRO regulations. However, international use is also possible due to the adaptability of matching and risk categorization.

With the combination of KYC Toolbox and Expert Service, backlogs are history. Using an API connection, compliance-relevant data, onboarding, KYC checks and the required compliance forms are automatically collected according to the process defined in your compliance concept. This can be for a simple KYC check, regular re-checks of your existing customers and business partners, or for a new customer onboarding including form generation, document upload and complete audit trail, and the final risk assessment (by your compliance officer).

We manage your KYC process, allowing you to focus on your core business. Our partners and compliance experts will manage your KYC process in line with your compliance concept and deliver audit-compliant and complete KYC dossiers for you - including forensic reports if required.

Learn more about KYC in the banking environment and how you can simplify your compliance with Digital KYC.

Sources:

[further] www.kyc.ch

Digital KYC bietet Ihnen eine einfache, intelligente und sichere Überprüfung und Identifizierung Ihrer Geschäftsbeziehungen.

Lernen Sie mit unserem Newsletter die Welt von KYC 4.0 und Compliance besser kennen. Wir senden Ihnen wöchentlich die wichtigsten Neuigkeiten direkt in Ihr Postfach.

Adresse

Eurospider Information Technology AG

Winterthurerstrasse 92

8006 Zürich

Telefon

Eurospider offers all the necessary compliance services relevant not only for finance intermediaries, banks and insurance, but also for fintechs, casinos and industrial corporations: Embargo, sanctions screening, PEP and crime check and compliance documentation.

Eurospider Information Technology AG

Winterthurerstrasse 92

8006 Zürich

Schweiz